How Do You Get A Copy Of Your Bankruptcy Discharge Papers Can Be Fun For Anyone

Table of Contents7 Simple Techniques For How Do I Get A Copy Of Bankruptcy Discharge PapersHow Bankruptcy Discharge Paperwork can Save You Time, Stress, and Money.Not known Factual Statements About How Do I Get A Copy Of Bankruptcy Discharge Papers The 10-Minute Rule for Copy Of Bankruptcy DischargeThe Definitive Guide for How To Obtain Bankruptcy Discharge LetterThe Ultimate Guide To How Do You Get A Copy Of Your Bankruptcy Discharge Papers

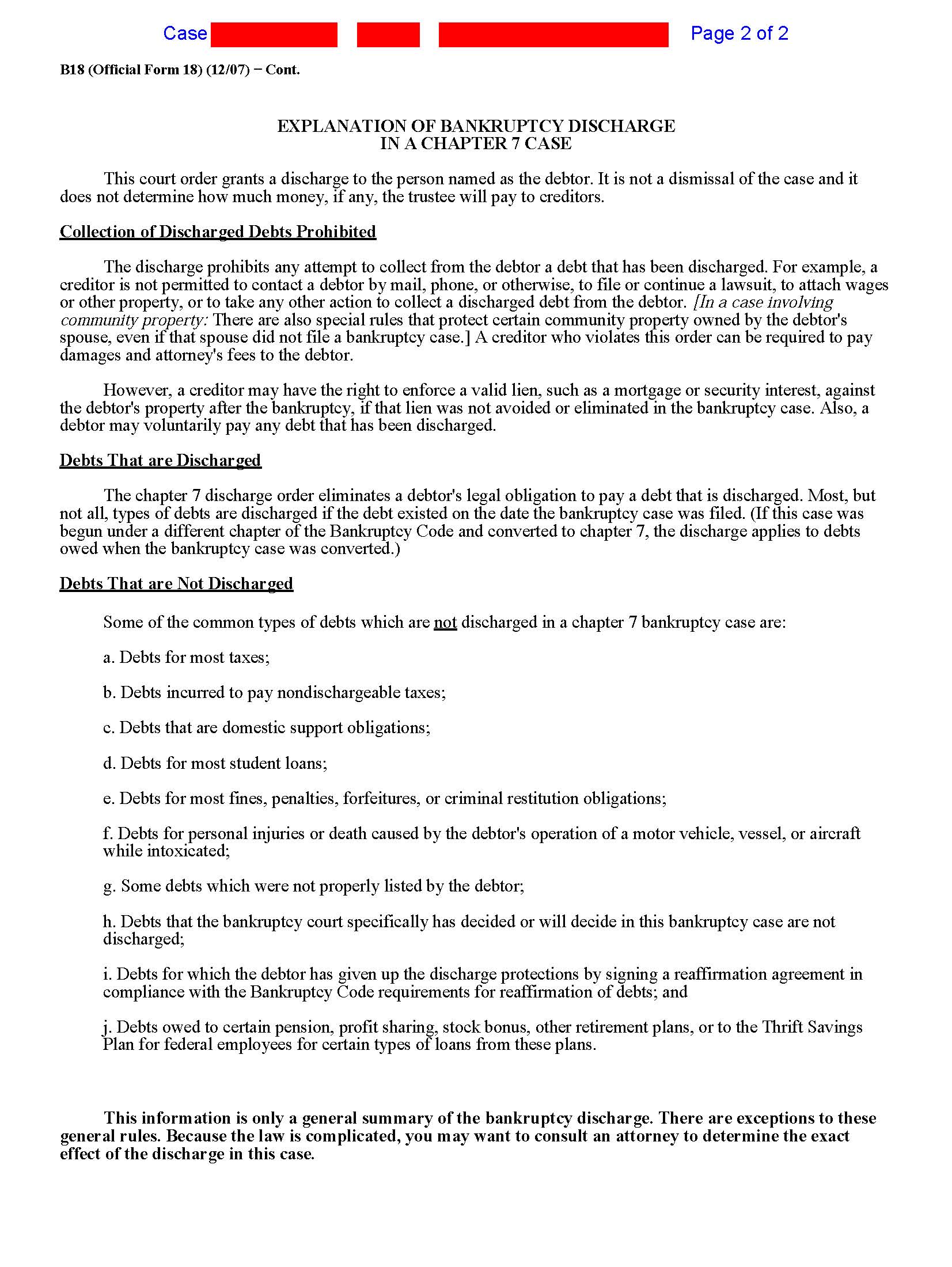

Among the factors individuals submit bankruptcy is to get a "discharge." A discharge is a court order which states that you do not need to pay the majority of your financial debts. Some debts can not be released. As an example, you can not release debts for most taxes; child support; alimony; most trainee lendings; court fines and also criminal restitution; and also individual injury brought on by driving drunk or intoxicated of drugs.

You can just obtain a phase 7 discharge when every 8 years. Various other guidelines may use if you previously received a discharge in a chapter 13 instance. No one can make you pay a financial obligation that has been released, yet you can willingly pay any kind of financial debt you want to pay.

The smart Trick of Copy Of Bankruptcy Discharge That Nobody is Discussing

Some lenders hold a safeguarded claim (for example, the bank that holds the home mortgage on your residence or the lender that has a lien on your auto). You do not need to pay a protected claim if the debt is discharged, yet the creditor can still take the property.

If you are an individual and you are not represented by a lawyer, the court has to hold a hearing to determine whether to accept the reaffirmation contract. The agreement will certainly not be legitimately binding up until the court accepts it. If you declare a financial obligation and after that stop working to pay it, you owe the debt the same as though there was no personal bankruptcy - https://slides.com/b4nkrvptcydcp.

The 6-Minute Rule for How Do I Get A Copy Of Bankruptcy Discharge Papers

The lender can additionally take lawful action to recuperate a judgment versus you - https://513326.8b.io/. Modified 10/05.

To request court records online, please total the type below (https://anotepad.com/notes/eai83xpf). If you are requesting to review court documents at the courthouse, you will certainly be called when the situation file is readily available to evaluate. If you are requesting to buy copies of court documents, you will certainly be contacted with price as well as a delivery time price quote.

Do NOT send your social safety and security number, bank or credit rating card details with this portal. The clerk can not ensure the safety and security of information or records sent with this website. In enhancement, any kind of document, documents, or files sent out to the clerk by means of this site might be divulged in accordance with Florida's Public Records Law.

The Best Strategy To Use For How To Obtain Bankruptcy Discharge Letter

A Phase 13 bankruptcy discharge is a very effective point. It stops your creditors from going after released debts completely. But it can also be puzzling. how do i get a copy of bankruptcy discharge papers. Let's respond to a few of the typical questions about the Chapter 13 discharge. A "discharge" is the fancy legal term for your debts being forgiven in your bankruptcy.

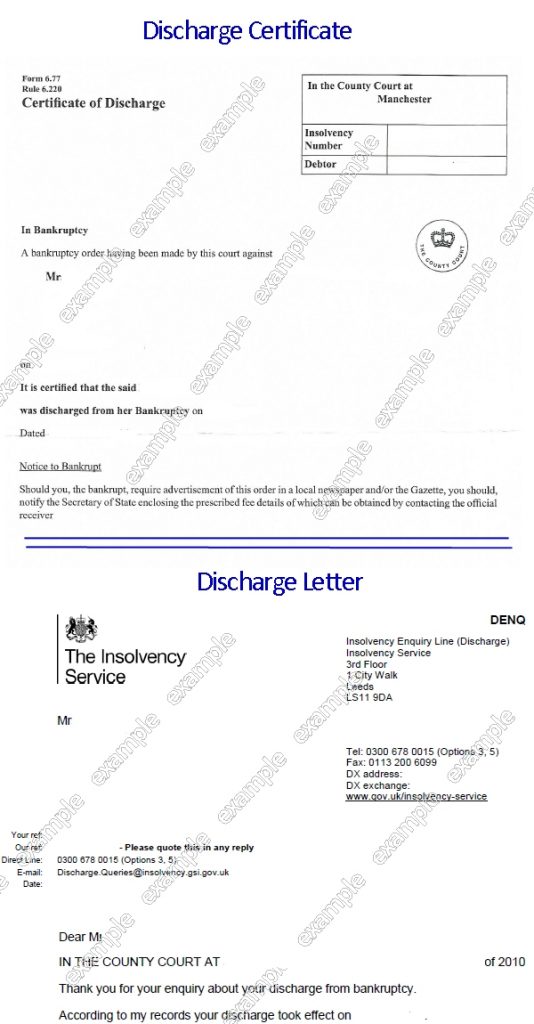

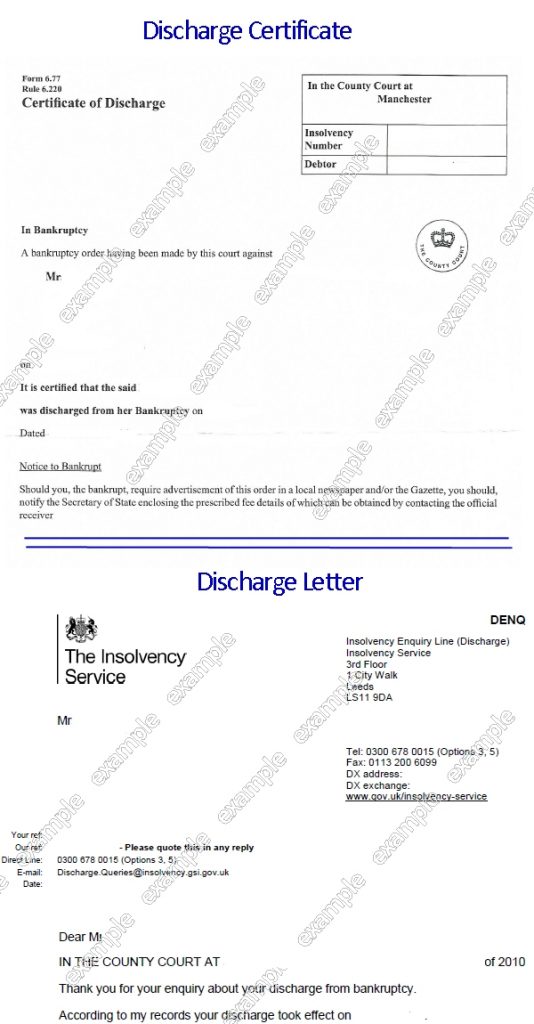

The Chapter 13 "discharge order" is the hop over to here final order you get in your Chapter 13 bankruptcy. It is signed by the personal bankruptcy court appointed to your situations as well as states clearly that you have obtained a Chapter 13 discharge. Simply put, it is the official paper that releases you of your debts.

We ought to note that there are 2 kinds of discharge under Chapter 13. The first is the normal discharge provided upon conclusion of plan payments. This is called an Area 1328(a) discharge. The second is called a "hardship discharge" and also is occasionally called a Section 1328(b) discharge. The hardship discharge is much less common.

How Do You Get A Copy Of Your Bankruptcy Discharge Papers Can Be Fun For Everyone

While every court is a little different, the Chapter 13 discharge order looks comparable. It is authorized by a court and also states that "A discharge under 11 U.S.C. 1328(a) is provided to: Your Name". When you obtain your discharge, your lenders are "urged" from seeking the financial debt. That indicates that the court has actually gotten them to quit collection activity.

We usually see this in cases where debt collection firms proceed to send out repayment needs also though the person obtained the discharge. One of the greatest points regarding insolvency is that your debt is released tax obligation complimentary - copy of bankruptcy discharge.

You would need to pay tax on any type of cash forgiven by the financial debt collector. In insolvency, the discharge makes it so that the financial obligation mercy is not taxed. This happens. It's an accountancy issue for the lender. No fears though. You can simply complete an IRS Type 982 when you finish your income tax return to explain you have an insolvency discharge.

All about How To Obtain Bankruptcy Discharge Letter

, however usually, you will obtain the discharge order about 1-3 months after finishing your Phase 13 plan settlements. The length of your Chapter 13 plan varies from case to situation.

Most financial obligations are dischargeable in Chapter 13 with a few exemptions. So we generally start by thinking the financial obligation is dischargeable unless an exemption uses. The common exemptions to dischargeability are: The Phase 13 discharge is even more comprehensive than the Chapter 7 discharge. Much more financial debts are dischargeable in Phase 13 than in Phase 7.